Navigating the Maze: A Guide to NY Car Insurance Quotes

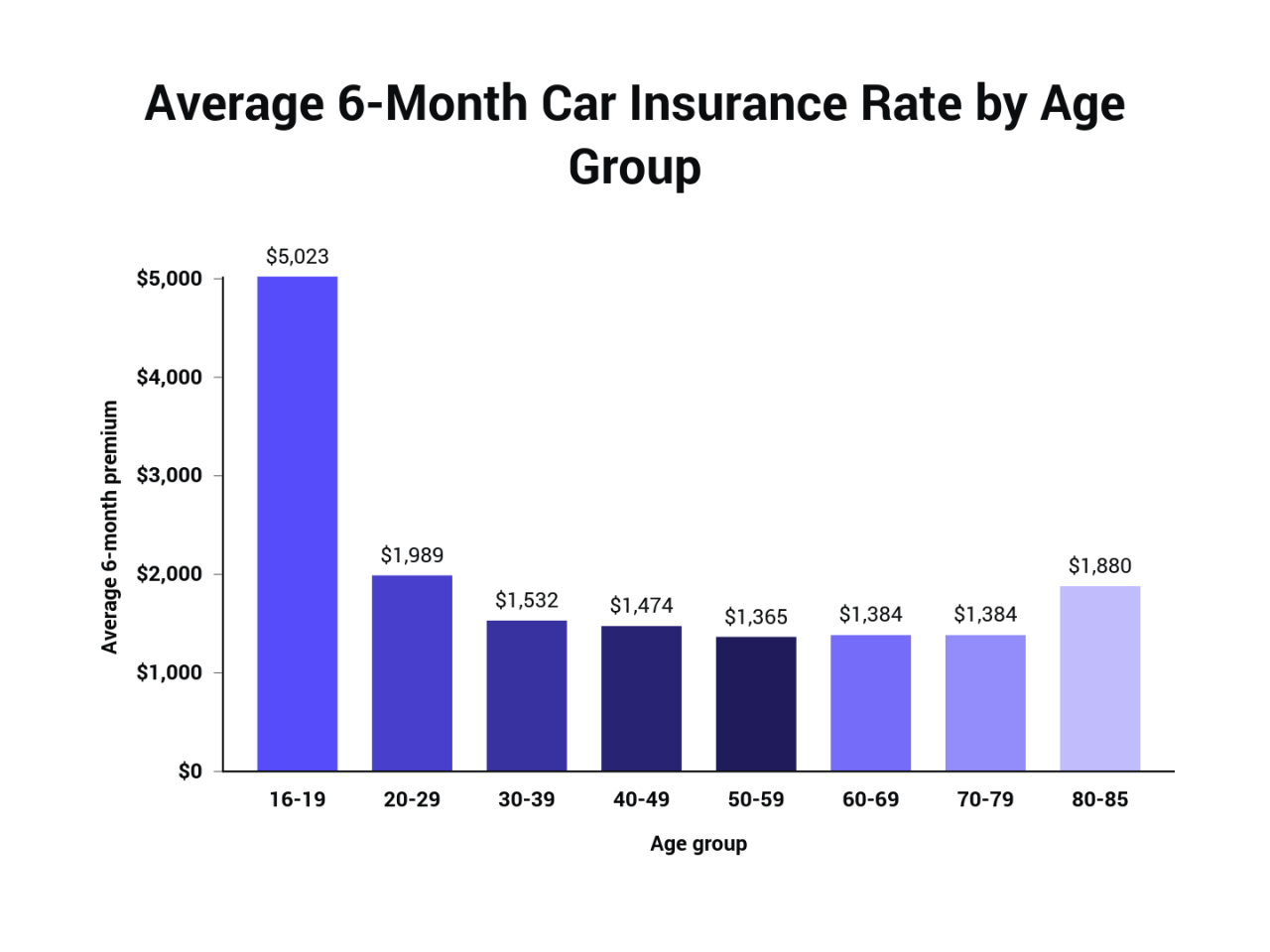

In the bustling streets of New York City, navigating the complexities of car insurance can feel like a daunting task. With a multitude of providers, coverage options, and ever-changing regulations, finding the right car insurance quote can seem like an insurmountable hurdle. But fear not, this comprehensive guide will equip you with the knowledge and strategies to secure the best possible coverage at a price that fits your budget. This guide will demystify the world of NY car insurance, covering everything from mandatory requirements to finding competitive quotes, understanding the factors that influence premiums, and navigating the intricacies of claims and coverage adjustments. We will also explore key discounts, compare leading providers, and provide valuable tips for safe driving in the Empire State. Understanding Car Insurance in New York Navigating the world of car insurance in New York can seem daunting, but understanding the basics can empower you to make informed decisions. This guide delves into the mandatory requirements, available coverage options, and factors influencing your premium. Mandatory Car Insurance Requirements New York State mandates all drivers to carry a minimum amount of liability insurance to protect themselves and others in case of an accident. These requirements are Artikeld in the New York State Financial Security Law. Bodily Injury Liability: This coverage protects you financially if you cause injury to another person in an accident. The minimum requirement is $25,000 per person and $50,000 per accident. Property Damage Liability: This coverage covers damage to another person’s property, such as their vehicle, in an accident. The minimum requirement is $10,000. It’s important to note that these are minimum requirements. You may want to consider higher coverage limits to ensure adequate protection in the event of a serious accident. Types of Car Insurance Coverage Beyond the mandatory liability coverage, various other insurance options can enhance your protection and peace of mind. Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault. Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. Personal Injury Protection (PIP): This coverage, also known as ”no-fault” insurance, pays for your medical expenses and lost wages regardless of who caused the accident. Medical Payments Coverage (Med Pay): This coverage supplements your health insurance and pays for medical expenses for you and your passengers, regardless of fault. Factors Influencing Car Insurance Premiums Your car insurance premium is determined by various factors, and understanding these can help you manage your costs. Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly influences your premium. A clean driving record generally results in lower premiums. Vehicle Type: The make, model, and year of your vehicle affect your premium. Luxury vehicles, high-performance cars, and newer models often come with higher premiums due to their higher repair costs and potential for theft. Location: Where you live impacts your premium. Areas with higher crime rates, traffic congestion, and accident frequency tend to have higher insurance rates. Age and Gender: Your age and gender can influence your premium. Younger drivers, particularly males, are statistically more likely to be involved in accidents, resulting in higher premiums. Credit Score: In some states, including New York, insurance companies may use your credit score as a factor in determining your premium. This practice is based on the correlation between credit score and risk of insurance claims. Driving Habits: Your driving habits, such as the number of miles you drive annually and your commuting distance, can affect your premium. Finding the Right Car Insurance Quote In New York, securing the most suitable car insurance policy involves a strategic approach. It’s crucial to be well-informed about the factors that influence your premium and actively seek out competitive quotes from multiple providers. Comparing Quotes from Multiple Providers It is essential to compare quotes from multiple insurance providers to find the most competitive rate. This involves contacting various insurance companies, providing them with your information, and comparing the quotes they provide. Online Comparison Tools: Websites such as Policygenius, The Zebra, and Insurify allow you to compare quotes from multiple insurance providers simultaneously, saving you time and effort. These platforms aggregate quotes from various companies, presenting them in a clear and concise manner. Directly Contact Insurance Companies: You can contact insurance companies directly to obtain quotes. This allows you to discuss your specific needs and ask questions about their policies. Work with an Insurance Broker: Insurance brokers act as intermediaries between you and insurance companies. They can help you find the best policy based on your individual needs and budget. Key Information Needed for a Quote To receive an accurate car insurance quote, insurance providers will require specific information about you, your vehicle, and your driving history. This information helps them assess your risk profile and determine your premium. Vehicle Details: Year, make, and model of your vehicle Vehicle Identification Number (VIN) Mileage Driving History: Driving record, including any accidents, violations, or DUI convictions Years of driving experience Driving history in other states Personal Information: Name, address, and date of birth … Read more