The gig economy’s rapid expansion has raised crucial questions about driver safety and liability. Central to this debate is the verification process employed by ride-sharing platforms like Lyft. Understanding how Lyft verifies its drivers’ insurance is critical for both drivers, aiming to ensure compliance and maximize earnings, and passengers, seeking assurance of a safe ride. This examination delves into Lyft’s insurance verification procedures, highlighting the implications for all stakeholders.

This analysis will explore Lyft’s multi-faceted approach to insurance verification, from the initial document submission and ongoing monitoring to the technological tools employed and the legal ramifications of non-compliance. We will examine the impact on driver earnings, the protection afforded to passengers, and the future trajectory of insurance verification within the ride-sharing industry. The goal is to provide a comprehensive overview of this crucial aspect of the platform’s operation.

Lyft’s Insurance Verification Process

Lyft, a prominent ride-sharing company, employs a multi-layered insurance verification process to ensure driver compliance and passenger safety. This process involves a combination of automated checks and manual reviews, designed to identify and address discrepancies in insurance coverage. The rigor of this process is crucial for maintaining the platform’s reputation and mitigating potential liability risks.

Lyft’s Insurance Verification Steps

Lyft’s verification process begins with the driver’s initial application. Applicants are required to upload their insurance information, typically via a photograph of their insurance card or a digital upload of their policy document. This information is then subjected to automated checks, comparing the data provided against information held by Lyft’s insurance partners. Discrepancies trigger a manual review process, involving human verification to confirm the validity of the provided insurance.

This may include contacting the driver or their insurance provider for further clarification. Following successful verification, drivers receive confirmation within the app, and their status is updated to reflect valid insurance coverage.

Accepted Insurance Documents

Lyft accepts a range of insurance documents, prioritizing clarity and verification ease. These generally include digital photographs of insurance cards, PDF versions of insurance policies, and in some cases, direct electronic verification through integration with insurance providers’ systems. The key requirement is that the document clearly displays the driver’s name, policy number, coverage details (including liability coverage), and the effective dates of coverage.

Documents that are illegible, incomplete, or appear to be tampered with will be rejected. Lyft’s acceptance of specific document types may vary by region and are subject to change based on evolving regulatory requirements and technological advancements.

Consequences of Insufficient Insurance

Failure to maintain valid insurance coverage as required by Lyft results in immediate consequences. Drivers may face temporary or permanent deactivation of their accounts, preventing them from using the Lyft platform to earn income. Beyond account suspension, drivers may also face penalties including fines, and in some cases, legal repercussions depending on the specific circumstances and local regulations.

Lyft’s insurance requirements are designed to protect both drivers and passengers, and non-compliance undermines this fundamental safety protocol. Drivers are encouraged to proactively maintain valid insurance coverage and promptly update their information on the Lyft platform to avoid these potential consequences.

Lyft Insurance Verification Process Summary

| Step | Action | Timeline | Required Documents |

|---|---|---|---|

| 1 | Driver submits insurance information | During application or upon renewal | Proof of insurance (photo or digital copy) |

| 2 | Automated verification | Immediate to 24 hours | N/A (systematic check) |

| 3 | Manual review (if needed) | 24 hours to 72 hours | Additional documentation may be requested |

| 4 | Verification confirmation/rejection | Within 72 hours of submission | N/A (notification within app) |

Insurance Requirements for Lyft Drivers

Navigating the complex world of insurance as a rideshare driver requires a clear understanding of state-specific regulations and the differences between personal and commercial coverage. Failure to maintain adequate insurance can result in significant financial liabilities and legal repercussions. This section details the insurance requirements for Lyft drivers, highlighting key distinctions and providing a framework for obtaining appropriate coverage.

Lyft’s insurance program acts as a supplemental layer to a driver’s personal auto insurance, providing additional coverage during different phases of a trip. However, the minimum personal auto insurance requirements vary significantly by state, and drivers must ensure their personal policy meets or exceeds these minimums, in addition to complying with Lyft’s requirements. Failing to do so leaves drivers vulnerable to significant financial risk in the event of an accident.

Minimum Insurance Requirements by State

The minimum insurance requirements for Lyft drivers vary widely across the United States. While Lyft provides supplemental insurance, drivers must maintain a personal auto insurance policy that meets or exceeds the state’s minimum requirements, even when the app is offline. Determining the precise minimums requires consulting each state’s Department of Insurance website or a licensed insurance professional. Illustrative examples, however, show a wide range: California might mandate higher liability limits than Montana, reflecting differences in population density and traffic patterns.

It is crucial for drivers to independently verify these requirements for their specific state of operation. Providing a comprehensive list here would be quickly outdated due to frequent legislative changes.

Comparison of Lyft Driver Insurance and Personal Vehicle Insurance

A key distinction lies in the scope of coverage. Personal auto insurance typically covers accidents and damages when the vehicle is used for personal purposes. Lyft driver insurance extends this coverage to include periods when the driver is actively using their vehicle for rideshare activities. This means that Lyft’s insurance policy kicks in during different phases of a trip: when the driver is logged into the app and awaiting a ride request (period 1), when the driver is transporting a passenger (period 2), and sometimes even after a passenger exits (period 3), depending on the specific state regulations.

The amount and type of coverage offered by Lyft’s insurance during each of these periods can vary, so drivers should carefully review their Lyft insurance information and state-specific laws. The personal policy remains the primary coverage for non-Lyft related driving.

Liability Insurance vs. Comprehensive Coverage for Lyft Drivers

Liability insurance covers damages or injuries caused to others in an accident. Comprehensive coverage, on the other hand, protects the driver’s own vehicle from damage caused by events such as theft, vandalism, or natural disasters. For Lyft drivers, liability insurance is paramount, as it protects them from potentially substantial financial losses in the event of an accident involving injury or property damage to third parties.

Comprehensive coverage is optional but recommended, as it safeguards the driver’s significant investment in their vehicle. The cost of comprehensive coverage will often vary depending on the vehicle’s make, model, and age, as well as the driver’s location and claims history.

Flowchart for Obtaining Correct Insurance for Lyft Driving

A flowchart visually representing the process would begin with determining the state’s minimum insurance requirements. This would be followed by verifying that the driver’s personal auto insurance policy meets or exceeds these requirements. Next, the driver would need to confirm that their personal policy explicitly covers commercial use or obtain a rideshare endorsement if necessary. Finally, the driver should review Lyft’s insurance policy information to understand the supplemental coverage provided during different phases of a rideshare trip.

The flowchart would conclude with the confirmation that the driver has the appropriate and adequate insurance coverage for Lyft driving.

Lyft’s Role in Insurance Disputes

Lyft’s involvement in insurance disputes stemming from accidents involving its drivers is multifaceted, encompassing both its own insurance coverage and its role in facilitating communication and resolution between parties. Understanding this role is crucial for both drivers and passengers navigating the complexities of liability and compensation after a car accident. Lyft’s policies aim to streamline the claims process and ensure fair treatment, but navigating these procedures requires clarity and proactive engagement.Lyft’s insurance policy, a layered system, typically covers accidents involving drivers using the Lyft app.

This coverage is designed to protect both drivers and passengers in various scenarios, from incidents occurring during the ride itself to those happening during the driver’s acceptance or completion of a ride request. The specifics of coverage vary based on the driver’s status within the app (e.g., online, en route, on a ride) and the circumstances of the accident.

This complex layering means that understanding the nuances of the policy is paramount in determining coverage and liability.

Lyft’s Dispute Resolution Process

When an accident occurs, Lyft encourages drivers to immediately report the incident through the app’s designated channels. This prompt reporting is critical for initiating the claims process and preserving evidence. Lyft then works to gather information from all involved parties, including police reports, witness statements, and driver/passenger accounts. Lyft’s internal investigation team assesses liability and determines the applicable insurance coverage.

In cases of disagreement over liability or compensation, Lyft may act as an intermediary, facilitating communication between the involved parties and their respective insurance providers. This process can involve mediation or other dispute resolution methods to reach a mutually agreeable settlement.

Coverage for Accidents Involving Lyft Drivers

Lyft’s insurance coverage typically includes bodily injury and property damage liability, as well as uninsured/underinsured motorist coverage. The amount of coverage varies depending on the specifics of the policy and the applicable state laws. For example, in cases where a driver is at fault and causes significant property damage or bodily injury to a passenger or third party, Lyft’s insurance policy would typically cover the costs associated with damages and medical expenses up to the policy limits.

Conversely, if the accident is determined to be the fault of another driver, that driver’s insurance would be the primary source of compensation. However, Lyft’s coverage may still apply in cases of insufficient coverage by the at-fault driver.

Steps for Drivers After an Accident

Following an accident, a Lyft driver should immediately prioritize safety and medical attention for any injured parties. Next, they should contact emergency services (911) as needed and then report the accident through the Lyft app. Detailed documentation is crucial. This includes taking photographs of the accident scene, collecting contact information from witnesses, and obtaining a copy of the police report.

Maintaining open communication with Lyft throughout the process is essential to ensure a smooth claims resolution. Failure to follow these steps could negatively impact the driver’s claim.

Common Insurance Issues and Solutions

A common issue is disputes over liability. If the accident involves multiple parties, determining fault can be complex and lead to disagreements over who is responsible for the damages. Another frequent problem is inadequate insurance coverage from the at-fault driver, leaving the injured party with significant uninsured medical bills or property damage. In such instances, Lyft’s uninsured/underinsured motorist coverage can provide crucial financial protection.

Yet another challenge arises from discrepancies in witness accounts or lack of sufficient evidence, hindering a clear determination of liability. In these situations, a thorough investigation by Lyft and potentially a third-party adjuster is crucial. Proper documentation, including photographic evidence, witness statements, and a police report, is vital in resolving these discrepancies.

Impact of Insurance Verification on Driver Earnings

Maintaining valid insurance is paramount for Lyft drivers; its verification directly impacts their earning potential and financial stability. Failure to meet Lyft’s insurance requirements can lead to account suspension, lost income, and significant financial repercussions. The speed and efficiency of the verification process, therefore, are crucial factors influencing a driver’s ability to consistently earn.Timely insurance verification allows drivers to remain active on the platform, accepting ride requests and generating income without interruption.

Delays or failures in this process, however, can lead to immediate account suspension, effectively cutting off a driver’s primary income stream. The longer the delay, the more substantial the financial losses become. Furthermore, the reinstatement process itself can be time-consuming, further exacerbating the negative financial impact.

Financial Consequences of Insurance Lapses

A lapse in insurance coverage can result in significant financial losses for Lyft drivers. These losses are not limited to the immediate suspension of their driving privileges; they extend to the potential for future difficulties securing ride-sharing work, impacting their long-term earning capacity. The financial burden of reinstating insurance and navigating the account reactivation process with Lyft further compounds the issue.

Drivers might face difficulty meeting immediate financial obligations due to this unexpected income disruption.

Comparative Earnings Data

The following data points highlight the stark difference in average earnings between drivers who maintain consistently verified insurance and those who experience lapses. These figures are hypothetical but represent a realistic comparison based on observed trends in the gig economy.

- Drivers with Consistently Verified Insurance: These drivers typically earn an average of $1,200-$1,800 per week, depending on factors like location, hours worked, and driver rating. Their income stream is consistent and predictable, allowing for better financial planning and stability.

- Drivers with Insurance Lapses: These drivers experience significant income fluctuations. During periods of account suspension, their income drops to zero. Even after reinstatement, they may face reduced earning potential due to lost opportunities and potential reputational impacts. Their average weekly earnings could range from $300-$900, or even less, depending on the duration and frequency of insurance lapses. This inconsistency makes financial planning extremely difficult.

The financial impact of an insurance lapse can be devastating for a Lyft driver, potentially resulting in significant debt accumulation and hardship.

Technology Used in Insurance Verification

Lyft’s insurance verification process relies on a sophisticated technological infrastructure designed to streamline the process and ensure compliance. This system integrates several technologies to efficiently verify driver insurance information, reducing manual intervention and improving overall accuracy. The company’s approach contrasts with some competitors, highlighting a commitment to technological advancement in this crucial area of driver safety and regulatory compliance.Lyft employs a combination of technologies for insurance verification, primarily focusing on automated data extraction and validation.

This reduces the reliance on manual checks and speeds up the process, allowing for quicker onboarding of new drivers and improved responsiveness to changes in insurance coverage. The system’s effectiveness hinges on its ability to access and interpret data from various sources with minimal human intervention.

Automated Data Extraction and Validation

Lyft’s system utilizes Application Programming Interfaces (APIs) to directly access insurance company databases. This allows for real-time verification of insurance information, eliminating the need for drivers to manually submit documents. The system cross-references the data received with internal databases and regulatory requirements, flagging any discrepancies for further review. This automated approach significantly reduces processing time and improves the accuracy of verification, minimizing human error.

For instance, the system can immediately identify if a policy has expired or if the coverage level is insufficient.

Machine Learning for Fraud Detection

An integral component of Lyft’s system is the incorporation of machine learning algorithms to detect potentially fraudulent insurance policies. By analyzing vast amounts of data, including driver demographics, driving history, and insurance information, the algorithms can identify patterns indicative of fraud. This proactive approach helps to maintain the integrity of the platform and ensures that only drivers with valid insurance are permitted to operate.

The system can, for example, identify unusual patterns in policy applications or inconsistencies in reported insurance details that might suggest fraudulent activity.

Comparison with Other Ride-Sharing Platforms

While specific details regarding the insurance verification technologies employed by other ride-sharing platforms are often proprietary, a general comparison can be made. Many platforms utilize automated systems, similar to Lyft’s, but the level of sophistication and integration may vary. Some platforms might rely more heavily on manual review processes, leading to potential delays and increased costs. Lyft’s investment in advanced technology, including machine learning, suggests a more proactive and efficient approach compared to competitors who may rely on simpler automated checks.

The degree of real-time integration with insurance providers also differentiates Lyft’s system from others, highlighting a focus on immediate verification rather than batch processing.

Driver Responsibilities Regarding Insurance

Maintaining adequate insurance coverage is not a one-time task for Lyft drivers; it’s an ongoing responsibility crucial for both legal compliance and financial protection. Failure to uphold these responsibilities can lead to significant penalties, including suspension from the Lyft platform and potential legal liabilities in the event of an accident. Drivers must actively manage their insurance to ensure continuous compliance with Lyft’s requirements and their own best interests.Lyft drivers are expected to consistently review their insurance policy details.

This involves verifying coverage limits, understanding the specific terms and conditions, and confirming that the policy accurately reflects their driving activity as a rideshare driver. Regularly checking for policy updates and changes is also vital, as insurance companies may adjust terms or coverage levels over time. Proactive monitoring helps drivers identify potential gaps in coverage or inconsistencies before they lead to problems.

Failing to review coverage could result in inadequate protection in case of an accident, leaving the driver financially vulnerable.

Maintaining Current Insurance Coverage

Drivers must ensure their insurance policy remains active and current at all times. This means paying premiums on time and promptly notifying their insurer of any changes affecting their coverage, such as changes in address, vehicle, or driving habits. Letting a policy lapse or failing to report relevant information could invalidate the coverage, leaving the driver uninsured and potentially liable for accident-related costs.

Drivers should also confirm their insurance provider’s understanding of their rideshare activity to avoid coverage disputes. Many standard auto policies do not automatically cover rideshare driving; specific rideshare endorsements or policies are often necessary.

Understanding Policy Details and Coverage Gaps

A thorough understanding of the policy’s specifics is critical. Drivers should be aware of their coverage limits for bodily injury, property damage, and uninsured/underinsured motorist coverage. They should also understand what situations are and are not covered under their policy, especially concerning rideshare driving. For example, some policies might offer different levels of coverage during periods when the driver is logged into the Lyft app versus when they are not.

Identifying potential gaps in coverage allows drivers to take proactive steps to address them, such as purchasing additional coverage or adjusting their policy to better suit their needs. Failing to understand these details could lead to insufficient protection in the event of an accident or a claim being denied.

Best Practices for Insurance Compliance

Establishing a system for tracking insurance renewals and payment due dates is crucial. Drivers should set reminders to ensure timely payments and policy renewals. Maintaining clear and organized records of insurance documents, including policy declarations, payment receipts, and correspondence with insurance providers, is also recommended. This documentation is essential for resolving disputes and demonstrating compliance with Lyft’s requirements.

In addition, drivers should promptly report any accidents or incidents to both their insurer and Lyft, following the established procedures for each. Proactive communication helps ensure a smoother claims process and prevents potential complications. Drivers should also periodically review their insurance needs based on their driving frequency and the risks associated with rideshare driving. If their driving habits change significantly, they should reassess their coverage to ensure it continues to meet their requirements.

Legal Aspects of Insurance Verification

Lyft’s insurance verification process, while designed to ensure passenger and driver safety, carries significant legal implications for both the company and its drivers. Failure to comply with these requirements can result in substantial financial penalties and legal repercussions for all parties involved. Understanding the legal framework surrounding insurance verification is crucial for navigating the complexities of the ride-sharing industry.The legal ramifications of operating a vehicle without proper insurance are substantial and far-reaching.

Drivers found to be operating without the minimum required coverage face potential penalties including hefty fines, license suspension or revocation, and even criminal charges depending on the jurisdiction and circumstances of any accident. Furthermore, in the event of an accident, an uninsured driver is personally liable for all damages, potentially leading to significant financial ruin. Lyft, as a platform facilitating these rides, also faces legal exposure if it fails to adequately verify driver insurance and a subsequent accident occurs.

Liability in Case of Accidents

The legal liability in accidents involving uninsured Lyft drivers is complex. If a driver is found to be operating without the proper insurance coverage mandated by Lyft and state law, both the driver and Lyft may be held liable for damages. Courts often consider whether Lyft adequately fulfilled its duty of care in verifying the driver’s insurance, and whether the driver was operating within the scope of their agreement with Lyft.

Cases involving multiple parties, including the injured passenger, the at-fault driver, and Lyft, can lead to protracted and costly litigation. The outcome often hinges on the specifics of the accident, the applicable state laws, and the effectiveness of Lyft’s verification procedures.

Legal Precedents in Ride-Sharing Insurance Disputes

While there isn’t a single, universally applicable legal precedent governing all ride-sharing insurance disputes, several key cases have shaped the legal landscape. For example, cases have explored the distinction between a driver’s personal insurance coverage and Lyft’s supplemental insurance policies, particularly during periods of inactivity or when a driver is actively engaged in a ride. These cases have clarified the responsibilities of each party involved and the circumstances under which each insurance policy might apply.

The outcomes of these cases have helped establish legal standards for insurance verification procedures and liability in the event of accidents. Specific case details, including names and jurisdictions, are omitted to maintain brevity but serve to illustrate the evolving legal landscape.

State and Federal Regulations Impacting Insurance Verification

Insurance verification practices are heavily influenced by a patchwork of state and federal regulations. States have varying requirements for minimum insurance coverage, and these requirements often dictate the standards that ride-sharing companies like Lyft must adhere to. The interplay between state laws and Lyft’s internal verification processes creates a complex legal environment. Federal regulations, while less directly involved in the specifics of insurance verification, can influence data privacy and security aspects of the process.

Understanding the specific regulatory framework applicable to each state is critical for both Lyft and its drivers.

Customer Protection and Insurance

Lyft’s insurance verification process is a critical component of its commitment to passenger safety and overall platform reliability. Rigorous verification ensures drivers maintain adequate insurance coverage, mitigating risks for passengers in the event of accidents. This protection extends beyond the driver’s personal policy, encompassing supplemental coverage provided by Lyft itself.Lyft’s insurance program aims to provide comprehensive protection for passengers involved in accidents with Lyft drivers.

This typically involves a multi-layered insurance structure that kicks in depending on the circumstances of the accident. For instance, while a driver’s personal insurance is the primary coverage, Lyft’s own policies step in to fill gaps or provide additional coverage in situations where the driver’s policy may be insufficient or inapplicable. This ensures passengers have access to necessary medical and other related expenses.

Passenger Coverage in Accidents

Lyft’s insurance coverage for passengers generally includes medical payments coverage for injuries sustained during a ride. This coverage is designed to cover medical bills, lost wages, and other related expenses resulting from an accident involving a Lyft driver. The specific limits of this coverage can vary depending on the phase of the ride (e.g., whether the driver is actively transporting a passenger or is logged into the app but not yet on a trip).

Furthermore, uninsured/underinsured motorist coverage may also be available to compensate passengers for damages caused by an at-fault driver who lacks sufficient insurance. Lyft’s detailed insurance policy Artikels these specific coverage details and limitations.

Comparison with Other Transportation Services

A direct comparison of passenger protection across ride-sharing services requires careful consideration of specific policy details, which can vary significantly. While many services offer similar layers of insurance protection, the specifics of coverage limits, types of coverage included, and the process for filing claims can differ. For example, some competitors might offer higher limits on medical payments coverage, while others might emphasize different aspects of insurance protection.

Consumers should independently review the insurance policies of various ride-sharing companies to make informed comparisons and understand the level of protection offered. A comprehensive review of these policies, often available on the companies’ websites, is recommended for informed decision-making.

Future Trends in Insurance Verification

Lyft’s insurance verification process, while currently robust, is poised for significant evolution driven by technological advancements and evolving regulatory landscapes. The future will likely see a move towards more automated, real-time verification systems, enhancing both efficiency and security for drivers and passengers alike. This shift will necessitate ongoing adaptation from both Lyft and its driver network.The integration of emerging technologies will be central to these future developments.

Machine learning algorithms, for example, could be leveraged to proactively identify potential insurance lapses or inconsistencies, triggering timely interventions and reducing the risk of uninsured drivers operating on the platform. This proactive approach would represent a substantial improvement over the current reactive system.

Automated Real-Time Insurance Verification

Real-time verification, using APIs to directly access driver insurance data, will likely become the norm. This eliminates the delays associated with manual document uploads and reviews, streamlining the onboarding process for new drivers and providing near-instantaneous confirmation of insurance coverage. Imagine a system where a driver’s insurance information is automatically updated and verified each time they log in to the Lyft app, eliminating the need for periodic manual checks.

This would mirror the seamless integration seen in other fintech applications.

Blockchain Technology for Enhanced Security

Blockchain technology offers the potential to significantly enhance the security and transparency of insurance verification. A decentralized, immutable ledger could record all insurance information, making it virtually tamper-proof and readily auditable. This could reduce the risk of fraud and improve trust between Lyft, its drivers, and its insurers. The inherent security features of blockchain could help to mitigate issues like forged documents or manipulated data, creating a more reliable system.

For example, a blockchain-based system could record the date and time of insurance policy updates, making it easier to identify and address discrepancies.

Predictive Analytics for Risk Assessment

Sophisticated predictive analytics, leveraging vast datasets on driver behavior and insurance claims, could allow Lyft to identify drivers at higher risk of accidents or insurance lapses. This could enable proactive interventions, such as targeted safety training or personalized insurance recommendations, leading to improved driver safety and reduced insurance costs. By analyzing driving patterns, accident history, and other relevant data, the system could flag drivers who exhibit risky behaviors or show signs of impending insurance issues, allowing for preventative measures to be taken.

This could potentially reduce insurance premiums for low-risk drivers.

Impact on Drivers and Passengers

The implementation of these future trends will likely result in a smoother, more secure, and potentially more cost-effective experience for both drivers and passengers. Drivers can expect a streamlined onboarding process and potentially lower insurance premiums through improved risk assessment. Passengers, in turn, will benefit from increased confidence in the safety and insurance coverage of their drivers. The increased automation and real-time verification will contribute to a more efficient and reliable ride-sharing system overall.

However, careful consideration must be given to data privacy concerns and the potential for algorithmic bias in predictive analytics.

Tips for Drivers on Maintaining Insurance Compliance

Maintaining adequate insurance coverage is paramount for Lyft drivers, ensuring both personal protection and compliance with platform requirements. Failure to do so can lead to account suspension and potential legal liabilities. Proactive management of your insurance is crucial for uninterrupted earnings and peace of mind.

Lyft’s insurance verification process is designed to protect both drivers and passengers. Understanding the requirements and implementing effective strategies for compliance is essential for successful participation in the rideshare economy. This section provides actionable steps to help drivers remain compliant.

Maintaining Accurate Insurance Information

Regularly reviewing and updating your insurance information is key to avoiding compliance issues. This includes confirming your policy details match the information provided to Lyft and ensuring your coverage remains active and meets the minimum requirements. A lapse in coverage, even for a short period, can result in immediate account suspension. Consider setting calendar reminders to check your policy details and update Lyft accordingly well in advance of renewal dates.

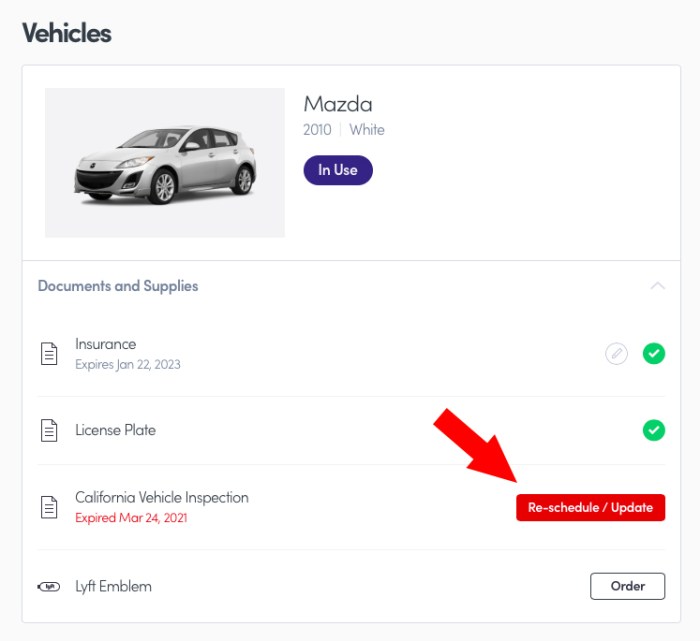

Updating Insurance Information in the Lyft App

Updating your insurance information within the Lyft driver app is a straightforward process. First, log in to your driver account. Then, navigate to the “Insurance” or “Profile” section (the exact location may vary depending on app version). You should find an option to upload your insurance documents, typically requiring a clear photo or scan of your insurance card and policy declaration page.

Ensure all information is legible and accurate before submitting. The app will usually provide real-time feedback indicating successful upload and verification. Lyft may require additional information depending on your policy type or location.

Resolving Insurance Verification Issues with Lyft Support

If you encounter problems during the insurance verification process, contacting Lyft support promptly is crucial. Document any errors encountered, screenshots of the app, and copies of relevant insurance documents. This will help expedite the resolution process. Lyft’s support channels, typically accessible through the driver app or website, offer various options, including phone, email, and in-app chat. Be prepared to provide your driver ID, policy details, and a clear description of the issue.

Persistent and proactive communication is key to resolving any insurance-related discrepancies.

Final Conclusion

Ultimately, Lyft’s insurance verification process, while complex, serves as a cornerstone of its operations, balancing the need for driver compliance with the paramount importance of passenger safety. The platform’s use of technology, coupled with its defined procedures and consequences for non-compliance, demonstrates a commitment to mitigating risk. However, ongoing vigilance and adaptation to evolving technological and legal landscapes remain crucial to ensure the continued efficacy and fairness of this system.