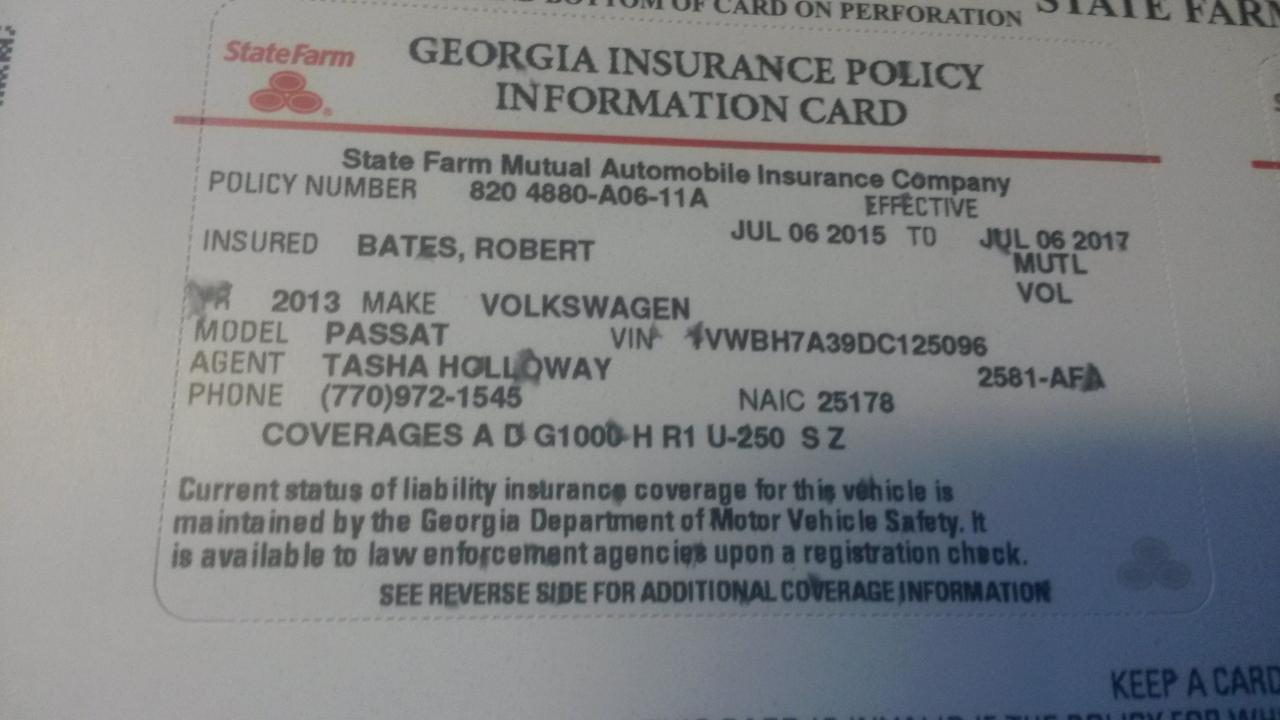

The insurance landscape is evolving rapidly, with traditional distribution models facing increasing pressure. In this dynamic environment, a new breed of insurance businesses is emerging: insurance farms. These specialized entities are revolutionizing how insurance products are sold and serviced, offering a unique blend of efficiency, specialization, and customer-centricity. Insurance farms are essentially networks of insurance agents or brokers who focus on a specific niche or type of insurance. They leverage economies of scale and specialized expertise to provide tailored solutions to their target market. This approach allows them to achieve greater market penetration, build stronger customer relationships, and ultimately, drive higher profitability. Insurance Farm An insurance farm, also known as a captive agency or exclusive agency, is a business model where an insurance agent or broker primarily represents and sells insurance products from a single insurance carrier. This model contrasts with independent insurance agents, who can represent multiple carriers and offer clients a wider range of options. Definition and Concept An insurance farm operates as a specialized sales and marketing unit dedicated to a particular insurance carrier. The agent or broker acts as a direct representative of the carrier, focusing on promoting and selling its specific insurance products. This close relationship allows the farm to develop a deep understanding of the carrier’s offerings and build strong relationships with its underwriting and claims teams. Purpose and Key Characteristics The primary purpose of an insurance farm is to generate significant sales volume for the insurance carrier. The agent or broker benefits from a dedicated focus on a single carrier’s products, allowing them to specialize in that carrier’s offerings and become experts in its underwriting guidelines and claims procedures. This specialization enables them to provide more tailored and efficient service to their clients, leading to higher customer satisfaction and retention. Real-World Examples of Insurance Farms Insurance farms are prevalent across various insurance sectors, including: * Property and Casualty Insurance: Agents specializing in selling homeowners, auto, and commercial insurance policies from a specific carrier. * Life Insurance: Agents focusing on selling life insurance products from a single carrier, often specializing in specific types of life insurance, such as term life or whole life. * Health Insurance: Brokers specializing in selling health insurance plans from a particular carrier, often focusing on employer-sponsored group health plans or individual health insurance policies. Examples of Insurance Products Specialized in Insurance farms typically specialize in a specific range of insurance products offered by their carrier. Some common examples include: * Homeowners Insurance: Covering damages to a homeowner’s property and liability for accidents occurring on the property. * Auto Insurance: Providing coverage for damage to a vehicle and liability for accidents involving the vehicle. * Life Insurance: Providing financial protection to beneficiaries in the event of the policyholder’s death. * Health Insurance: Covering medical expenses for individuals and families, including hospital stays, doctor visits, and prescription drugs. Benefits and Drawbacks of Insurance Farms Insurance farms offer both benefits and drawbacks for both agents and clients: Benefits for Agents: * Higher Commission Rates: Agents often receive higher commission rates from the carrier they represent exclusively. * Specialized Training and Support: Insurance farms receive dedicated training and support from the carrier, enhancing their expertise and sales capabilities. * Stronger Carrier Relationships: Exclusive relationships with carriers can lead to stronger partnerships and access to exclusive resources. Benefits for Clients: * Streamlined Service: Clients benefit from a single point of contact for all their insurance needs, simplifying the process of obtaining quotes, making changes, and filing claims. * Specialized Expertise: Agents specializing in a specific carrier’s products can offer more tailored advice and solutions based on their deep understanding of the carrier’s offerings. Drawbacks for Agents: * Limited Product Options: Agents are restricted to selling products from a single carrier, limiting their ability to offer clients a wider range of options. * Potential for Lower Sales Volume: Focusing on a single carrier can lead to lower sales volume compared to independent agents who can represent multiple carriers. Drawbacks for Clients: * Limited Choice: Clients may not have access to the full range of insurance products available in the market. * Potential for Higher Premiums: Insurance farms may not always offer the most competitive premiums compared to independent agents who can compare rates from multiple carriers. Types of Insurance Farms Insurance farms, also known as insurance lead generators, are businesses that specialize in generating leads for insurance agents and brokers. They operate by attracting potential customers interested in various insurance products and then connecting them with licensed insurance professionals. These farms play a crucial role in the insurance industry by streamlining the lead generation process for agents, allowing them to focus on providing expert advice and securing clients. Types of Insurance Farms Insurance farms can be categorized based on their specialization, focusing on specific insurance products or target markets. Some common types include: Life Insurance Farms: These farms focus on generating leads for life insurance products, such as term life, whole life, and universal life insurance. They typically target individuals seeking coverage for their families, estate planning, or business needs. They may employ various marketing strategies, including online advertising, social media campaigns, and direct mail marketing, to reach potential customers interested in life insurance. Health Insurance Farms: These farms specialize in generating leads for health insurance plans, including individual health insurance, family health insurance, and employer-sponsored plans. They target individuals and families seeking affordable and comprehensive health coverage. Their marketing strategies often involve educating potential customers about different health insurance options and providing comparisons of plans from various insurance providers. Property and Casualty Insurance Farms: These farms generate leads for property and casualty insurance products, such as homeowners insurance, renters insurance, auto insurance, and business insurance. They target individuals and businesses seeking protection against financial losses due to property damage, accidents, or liability claims. They may use online lead generation forms, targeted advertising, and partnerships with real estate agents and other businesses to attract potential customers. Specialty Insurance Farms: These farms focus on niche insurance markets, such as travel insurance, pet insurance, or disability insurance. They specialize in generating leads for specific insurance products tailored to particular needs or demographics. For example, a travel insurance farm might target frequent travelers seeking coverage for medical emergencies, trip cancellations, or lost luggage. Business Models and Target Markets Insurance farms employ various business models to generate leads and connect with potential customers. Some common approaches include: Lead Generation Websites: Many insurance farms operate websites designed to attract potential customers through informative content, online quizzes, and lead generation forms. These websites often provide resources and tools to educate visitors about different insurance products and help them find the right coverage for their needs. Affiliate Marketing: Insurance farms can partner with other businesses or websites to generate leads through affiliate marketing programs. This involves promoting insurance products on affiliate websites and earning commissions for successful referrals. Direct Mail Marketing: Traditional direct mail marketing remains a viable strategy for some insurance farms, especially those targeting specific demographics or geographic locations. They may send brochures, postcards, or other marketing materials to potential customers, highlighting the benefits of their insurance products. Social Media Marketing: Social media platforms provide a valuable channel for insurance farms to reach potential customers and build relationships. They can create engaging content, run targeted ads, and participate in online communities to generate leads and promote their services. The target market for insurance farms varies depending on their specialization and business model. Some farms focus on a broad audience, while others target specific demographics, such as young adults, seniors, or business owners. They may also specialize in serving particular industries or geographic regions. Benefits of an Insurance Farm The concept of an insurance farm, where multiple agents operate under a single umbrella, offers numerous advantages for both the agents and their clients. This collaborative approach allows for increased efficiency, specialization, and market penetration, ultimately leading to a more comprehensive and rewarding experience for all parties involved. Increased Efficiency Operating as an insurance farm allows agents to streamline their processes and focus on their core strengths. By sharing resources, expertise, and administrative tasks, agents can eliminate redundancies and allocate their time more effectively. Shared Infrastructure: Agents can share office space, administrative staff, and technology, reducing overhead costs and freeing up time for client interaction. This collaborative approach allows agents to leverage collective resources, maximizing efficiency and minimizing individual expenditures. Cross-Selling Opportunities: Agents can leverage each other’s expertise to cross-sell different insurance products, expanding their client base and offering a wider range of services. This cross-selling approach can lead to increased revenue and customer satisfaction, as clients benefit from a one-stop shop for their insurance needs. … Read more