Forbes Best Auto Insurance rankings offer consumers a valuable resource when navigating the often-complex world of auto insurance. These ratings are based on a comprehensive evaluation of factors ranging from cost and coverage options to customer service and financial stability. Forbes aims to identify companies that not only offer competitive premiums but also provide a positive overall experience for their policyholders.

The Forbes methodology considers a wide array of data points, including average premiums, available discounts, and the breadth of coverage options. Customer service is a key component, with Forbes scrutinizing claims handling processes and customer feedback to assess the quality of service provided by each insurer. Financial strength ratings from agencies like AM Best are also factored in, ensuring that recommended companies have the financial wherewithal to meet their obligations to policyholders.

Forbes’ Auto Insurance Recommendations

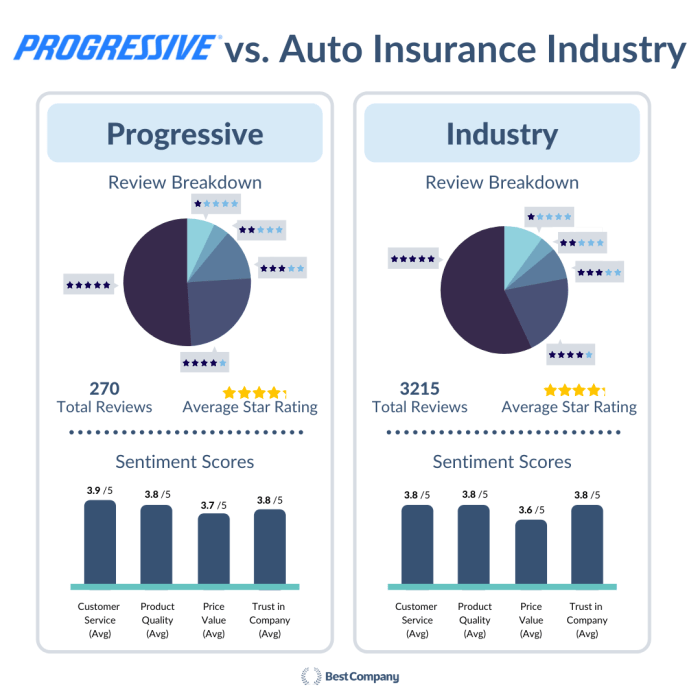

Forbes Advisor provides comprehensive auto insurance recommendations to help consumers make informed decisions. Their evaluations consider various factors, providing a holistic view of each insurance company’s strengths and weaknesses. This approach aims to guide individuals toward policies that best suit their specific needs and circumstances.The Forbes Advisor methodology prioritizes customer satisfaction, financial strength, and coverage options. By analyzing these key aspects, Forbes aims to identify insurers that offer both reliable protection and a positive customer experience.

The ultimate goal is to empower consumers to choose auto insurance policies that provide peace of mind and financial security.

Forbes’ Evaluation Criteria for Auto Insurance Companies

Forbes utilizes a multi-faceted approach to evaluate auto insurance companies. This involves analyzing data from various sources, including customer satisfaction surveys, financial ratings, and coverage details. The evaluation process aims to provide a comprehensive assessment of each company’s overall performance and value proposition.Forbes assesses auto insurance companies based on factors that include:

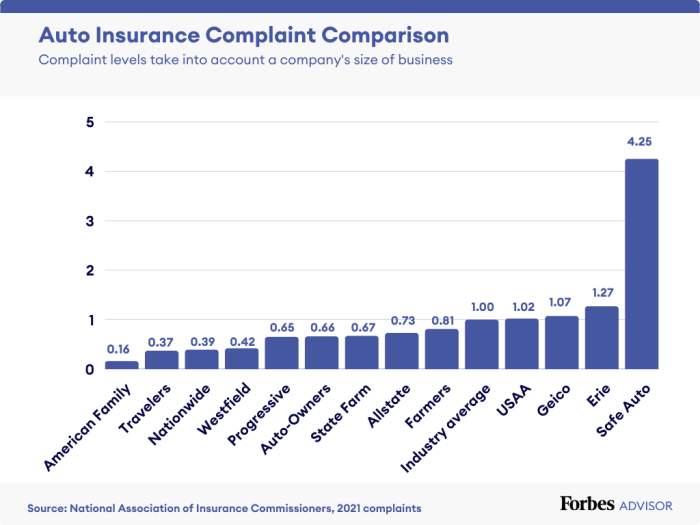

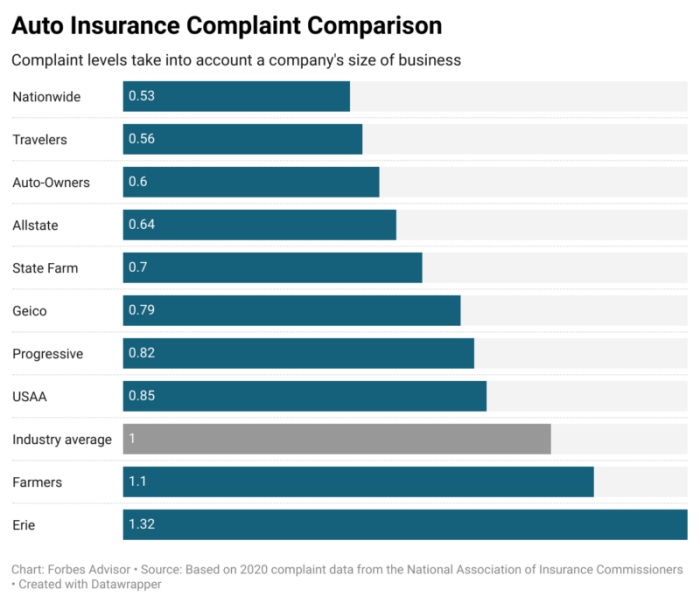

- Customer Satisfaction: This is often measured through surveys and complaint data from organizations like the National Association of Insurance Commissioners (NAIC). A low complaint ratio and high customer satisfaction scores contribute positively to the rating. For example, companies known for quick claims processing and helpful customer service representatives typically score higher in this area.

- Financial Strength: Forbes considers the financial stability of the insurance company, usually based on ratings from independent agencies like A.M. Best and Standard & Poor’s. A strong financial rating indicates the company’s ability to pay out claims even in challenging economic conditions. Insurers with superior financial ratings offer greater assurance to policyholders.

- Coverage Options: The availability of various coverage options, such as collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP), is also assessed. Companies offering a wide range of customizable coverage options that meet diverse customer needs are favored.

- Discounts: The availability and variety of discounts, such as those for safe driving, multiple vehicles, or bundling policies, are considered. Generous discount programs can significantly lower premiums, making the insurer more attractive to consumers.

- Claims Handling: The ease and efficiency of the claims process are important factors. Companies with streamlined claims processes, prompt communication, and fair settlement offers tend to receive higher ratings.

Factors Contributing to a High Forbes Rating

Several specific factors contribute to a high Forbes rating for auto insurance companies. These factors often reflect a combination of excellent customer service, robust financial health, and comprehensive coverage options. Companies that excel in these areas are more likely to receive favorable reviews and recommendations.The following aspects contribute significantly to a high Forbes rating:

- Exceptional Customer Service: Insurers known for providing prompt, courteous, and helpful customer service often receive higher ratings. This includes easy access to customer support channels and efficient resolution of inquiries and complaints.

- Strong Financial Stability: Companies with high financial strength ratings from agencies like A.M. Best are viewed more favorably. This indicates their ability to meet their financial obligations and pay out claims reliably.

- Competitive Pricing: While not the sole determinant, competitive pricing is an important consideration. Insurers that offer affordable rates without compromising coverage quality are often preferred.

- Positive Customer Reviews: Positive reviews and testimonials from policyholders contribute to a favorable reputation. This reflects a history of positive experiences and satisfied customers.

- Innovative Features: Companies that offer innovative features, such as usage-based insurance programs or mobile apps for claims management, may receive higher ratings. These features can enhance the customer experience and provide added convenience.

Auto Insurance Companies Frequently Mentioned in Forbes’ Recommendations

Several auto insurance companies are frequently mentioned in Forbes’ recommendations due to their consistently high ratings and positive customer feedback. These companies often excel in areas such as customer service, financial strength, and coverage options. They represent some of the leading providers in the auto insurance industry.Here are some auto insurance companies frequently featured in Forbes’ recommendations:

- State Farm: State Farm is often praised for its extensive network of agents, strong financial stability, and positive customer service reputation. They offer a wide range of coverage options and discounts, making them a popular choice for many drivers.

- GEICO: GEICO is known for its competitive pricing and convenient online services. They offer a variety of discounts and coverage options, catering to a broad range of customers. Their user-friendly website and mobile app make it easy to manage policies and file claims.

- Progressive: Progressive is recognized for its innovative offerings, such as the Snapshot program, which allows drivers to save money based on their driving habits. They also offer a variety of coverage options and discounts, making them a competitive choice.

- USAA: USAA is consistently ranked highly for its exceptional customer service and comprehensive coverage options. However, eligibility is limited to military members and their families. They are known for their competitive pricing and commitment to serving the military community.

- Allstate: Allstate offers a wide range of coverage options and discounts, with a strong focus on customer service. They provide various tools and resources to help customers understand their insurance needs and make informed decisions.

Cost Factors Influencing Forbes’ Top Picks

The cost of auto insurance is a primary consideration for most drivers, and Forbes’ evaluation process reflects this reality. While coverage quality and customer service are essential, affordability plays a significant role in determining which companies earn a spot on their list of recommended insurers. Understanding how Forbes weighs cost factors can help consumers make informed decisions when selecting a policy.Forbes analyzes a variety of cost-related elements to identify the best auto insurance options.

These factors go beyond simply looking at the lowest premiums; they encompass a broader view of value, considering what drivers receive in exchange for their insurance dollars.

Average Premiums’ Impact on Ranking

The average premium charged by an insurer is a crucial data point for Forbes. Companies with consistently higher-than-average premiums for comparable coverage levels are less likely to be ranked favorably. Forbes typically uses a combination of proprietary data and publicly available information from sources like the National Association of Insurance Commissioners (NAIC) to determine average premium costs. They may also consider premiums for different driver profiles (e.g., young drivers, drivers with clean records, drivers with accidents) to assess how insurers price risk.

For example, if Company A consistently charges 20% more than the national average for a basic liability policy across multiple driver demographics, it would likely be penalized in Forbes’ ranking.

Discounts and Payment Options in Forbes’ Ranking

Forbes does consider the availability of discounts and flexible payment options when evaluating auto insurers. A company that offers a wide range of discounts, such as safe driver discounts, multi-policy discounts, student discounts, and military discounts, can improve its overall ranking. Similarly, insurers that provide convenient payment options, like online payments, automatic deductions, and flexible payment schedules, are viewed more favorably.

These factors demonstrate an insurer’s commitment to providing value and accommodating the diverse needs of its customers. An example would be Company B, which offers a 10% discount for bundling home and auto insurance, a 5% discount for drivers with accident-free records for three years, and allows customers to choose their payment due date each month. This flexibility and range of discounts would positively influence Forbes’ assessment.

Forbes’ Presentation of Cost Information

Forbes typically presents cost information in a clear and accessible manner, using national averages and sample quotes to give readers a general idea of what they can expect to pay. They may provide national average premiums for different coverage levels (e.g., minimum liability, full coverage) and highlight insurers that consistently offer rates below these averages. Forbes may also present sample quotes for different driver profiles to illustrate how premiums can vary based on factors like age, driving history, and location.

It is important to note that these are just examples, and individual rates will vary based on specific circumstances. Forbes often emphasizes that the best way to determine the actual cost of insurance is to obtain personalized quotes from multiple insurers. For instance, Forbes might state: “The national average for full coverage auto insurance is $1,700 per year. However, drivers in Michigan may pay significantly more due to state regulations, while drivers in Maine may pay less due to lower accident rates.”

Coverage Options and Forbes’ Evaluation

Forbes’ evaluation of auto insurance goes beyond just price. It heavily emphasizes the breadth and depth of coverage offered, recognizing that comprehensive protection is crucial for financial security in the event of an accident or other covered incident. The following sections detail the types of coverage Forbes considers essential and how they assess the comprehensiveness of policies.Forbes prioritizes auto insurance companies that offer a wide range of coverage options to meet diverse needs.

This includes not only the standard liability, collision, and comprehensive coverages, but also additional options that can provide enhanced protection.

Essential Coverage Types

Liability coverage, collision coverage, and comprehensive coverage form the foundation of a robust auto insurance policy. Understanding the purpose of each type is essential when choosing the right coverage.

- Liability Coverage: This coverage protects you if you are at fault in an accident and cause injury or damage to someone else. It covers their medical expenses, property damage, and legal costs if they sue you. Forbes emphasizes the importance of having adequate liability limits to protect your assets. For example, if you cause a serious accident and are sued for $500,000, but only have $100,000 in liability coverage, you would be personally responsible for the remaining $400,000.

- Collision Coverage: This coverage pays for damage to your vehicle if you collide with another vehicle or object, regardless of who is at fault. This is beneficial if you are in an accident where you are at fault, or if the other driver is uninsured or underinsured. Forbes considers collision coverage important, especially for newer vehicles, as repair costs can be substantial.

For example, even a minor fender bender can result in thousands of dollars in repairs due to the cost of parts and labor.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. Forbes recognizes the value of comprehensive coverage, particularly in areas prone to specific risks. For example, if you live in an area with frequent hailstorms, comprehensive coverage can protect you from costly damage to your vehicle’s body and windshield.

Forbes’ Assessment of Coverage Comprehensiveness

Forbes evaluates the comprehensiveness of coverage by examining several factors beyond the basic policy offerings. This includes the availability of add-on coverages, the flexibility of policy limits, and the overall claims process.

- Availability of Add-on Coverages: Forbes looks for insurers that offer a variety of optional coverages to tailor policies to individual needs. Some examples include:

- Uninsured/Underinsured Motorist Coverage: Protects you if you are hit by a driver who has no insurance or insufficient insurance to cover your damages.

- Medical Payments Coverage (MedPay): Pays for medical expenses for you and your passengers, regardless of who is at fault.

- Personal Injury Protection (PIP): Similar to MedPay, but also covers lost wages and other expenses.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan if your car is totaled.

- Rental Car Reimbursement: Pays for a rental car while your vehicle is being repaired after a covered loss.

- Roadside Assistance: Provides assistance with services such as towing, jump-starts, and tire changes.

Forbes considers the presence and availability of these add-on coverages as a significant indicator of a company’s commitment to providing comprehensive protection.

- Flexibility of Policy Limits: Forbes assesses whether insurers offer a range of policy limits to allow customers to choose the level of coverage that best suits their individual circumstances and risk tolerance. Higher liability limits provide greater protection against lawsuits, while higher collision and comprehensive deductibles can lower premiums. Forbes favors companies that provide ample flexibility in these limits.

- Claims Process: A comprehensive policy is only valuable if the claims process is efficient and fair. Forbes considers factors such as ease of filing a claim, responsiveness of claims adjusters, and overall customer satisfaction with the claims experience. Companies with a reputation for smooth and hassle-free claims processing are rated more favorably.

Coverage Comparison: Top-Rated Companies

The following table provides a comparison of coverage options offered by three hypothetical top-rated auto insurance companies, illustrating the breadth and depth of coverage Forbes considers when making its recommendations.

| Coverage Option | Company A | Company B | Company C |

|---|---|---|---|

| Liability (Bodily Injury & Property Damage) | Yes, up to $500k/$100k | Yes, up to $1M/$500k | Yes, up to $300k/$50k |

| Collision | Yes, Deductibles $250-$1000 | Yes, Deductibles $0-$1000 | Yes, Deductibles $500-$1000 |

| Comprehensive | Yes, Deductibles $250-$1000 | Yes, Deductibles $0-$1000 | Yes, Deductibles $500-$1000 |

| Uninsured/Underinsured Motorist | Yes, up to policy limits | Yes, up to $500k | Yes, up to $100k |

| Medical Payments (MedPay) | Yes, up to $5,000 | Yes, up to $10,000 | No |

| Personal Injury Protection (PIP) | No | Yes, state-mandated limits | No |

| Gap Insurance | Yes | Yes | No |

| Rental Car Reimbursement | Yes, up to $50/day | Yes, up to $75/day | Yes, up to $30/day |

| Roadside Assistance | Yes | Yes | Yes |

This table is for illustrative purposes only. Actual coverage options and limits may vary. Consumers should always review policy documents carefully to understand the specific terms and conditions of their coverage.

Customer Service and Claims Handling

Customer service and claims handling are pivotal components in Forbes’ evaluation of auto insurance companies. Beyond competitive pricing and comprehensive coverage, the ease and efficiency with which insurers address customer needs and process claims significantly influence their overall ranking. A positive customer service experience can foster loyalty and trust, while a smooth claims process provides tangible proof of an insurer’s commitment to its policyholders.The quality of customer service and claims handling reflects an insurance company’s dedication to its clients and operational efficiency.

Forbes rigorously assesses these aspects to provide readers with a comprehensive understanding of each insurer’s capabilities.

Importance of Customer Service in Forbes’ Ranking Methodology

Forbes recognizes that auto insurance is not merely a financial transaction but a service-oriented product. The ability of an insurance company to provide prompt, courteous, and effective customer service is a crucial differentiator. Therefore, customer service plays a significant role in Forbes’ ranking methodology. Insurers demonstrating superior customer service are generally rewarded with higher ratings. Forbes considers several factors when evaluating customer service, including accessibility, responsiveness, and problem-solving abilities.

Companies offering multiple channels for communication, such as phone, email, and online chat, are viewed favorably. Quick response times to inquiries and efficient resolution of issues are also key indicators of strong customer service.

Forbes’ Evaluation of the Claims Handling Process

The claims handling process is often the moment of truth for policyholders, testing the insurer’s promises. Forbes meticulously evaluates how insurance companies handle claims, recognizing its critical impact on customer satisfaction. This evaluation encompasses several stages, from the initial reporting of the claim to the final settlement. Forbes assesses the ease of reporting a claim, the clarity of communication throughout the process, the fairness of the settlement offer, and the speed of payment.

Insurers that streamline the claims process, provide transparent updates, and offer fair settlements are generally ranked higher. Forbes also considers the availability of resources and support for policyholders during the claims process, such as dedicated claims adjusters and online tracking tools.

Examples of Customer Service Experiences Impacting Company Ratings

Customer service experiences, both positive and negative, can significantly influence an insurance company’s rating in Forbes’ evaluation.Consider these scenarios:

- Positive Experience: A policyholder involved in an accident reports the claim online and receives a prompt response from a dedicated claims adjuster. The adjuster guides the policyholder through the process, provides regular updates, and ensures a fair settlement is reached within a reasonable timeframe. The policyholder is satisfied with the efficient and professional service, leading to a positive review and potentially boosting the company’s rating.

- Negative Experience: A policyholder attempts to file a claim after a car theft but encounters difficulty reaching a representative by phone. When they finally connect, the representative is unhelpful and provides conflicting information. The claims process is delayed, and the settlement offer is significantly lower than expected. Frustrated with the poor service and unfair settlement, the policyholder files a complaint and shares their negative experience online, potentially damaging the company’s reputation and lowering its rating.

The impact of customer service extends beyond individual experiences. Consistently positive feedback from policyholders can enhance a company’s reputation and attract new customers, while a pattern of negative reviews can erode trust and lead to customer attrition. Forbes takes these factors into account when assessing the overall quality of customer service and its impact on an insurer’s ranking.

Financial Strength and Stability

Financial strength and stability are critical factors when choosing an auto insurance provider. A financially sound insurer is more likely to fulfill its obligations, particularly when it comes to paying out claims. Forbes recognizes this importance and incorporates financial strength assessments into its evaluation process, ensuring that its recommended insurers are capable of meeting their financial commitments to policyholders.

Forbes’ Assessment of Financial Stability

Forbes evaluates the financial stability of auto insurance companies by examining various financial metrics and relying on independent rating agencies. This assessment helps determine an insurer’s ability to pay claims and remain solvent, even in challenging economic conditions or following large-scale catastrophic events.

Significance of Financial Ratings

Financial ratings, particularly those from AM Best, play a significant role in Forbes’ evaluation. These ratings provide an independent assessment of an insurer’s financial strength and creditworthiness. AM Best, for example, assigns ratings ranging from A++ (Superior) to D (Poor), based on its analysis of an insurer’s balance sheet strength, operating performance, and business profile.The ratings assigned by AM Best and similar agencies (such as Moody’s and Standard & Poor’s) are based on a comprehensive analysis of an insurer’s:

- Balance Sheet Strength: This assesses the insurer’s capital adequacy, liquidity, and overall financial resources.

- Operating Performance: This evaluates the insurer’s profitability, efficiency, and ability to generate sustainable earnings.

- Business Profile: This considers the insurer’s market position, diversification, and management expertise.

These ratings serve as a shorthand for consumers, allowing them to quickly gauge the financial health of an insurance company. Forbes considers these ratings as an essential indicator of an insurer’s ability to meet its obligations.

Impact on Consumer Choice

An insurer’s financial strength directly impacts a consumer’s peace of mind. Choosing an insurer with a strong financial rating ensures that the company is likely to be able to pay out claims, even in the event of a major catastrophe. A lower rating, conversely, might suggest a higher risk of delayed or denied claims, or even potential insolvency.Here are some key ways financial strength impacts a consumer’s choice:

- Claims Payment Assurance: A financially stable insurer is more likely to have the resources to pay claims promptly and fairly.

- Long-Term Stability: A strong financial rating indicates that the insurer is likely to remain in business and continue providing coverage for the long term.

- Reduced Risk of Insolvency: Choosing a financially sound insurer minimizes the risk that the company will become insolvent and unable to fulfill its obligations.

For example, imagine two hypothetical insurance companies, “SafeInsure” with an AM Best rating of A++ and “RiskyCover” with a rating of C. A consumer would likely feel more secure choosing SafeInsure, knowing that it has a strong financial foundation and a proven track record of paying claims. While RiskyCover might offer slightly lower premiums, the risk of potential financial instability and claim payment issues could outweigh the cost savings.Consumers should prioritize financial strength when selecting an auto insurance provider.

While price is certainly a consideration, the ability of an insurer to pay claims is paramount. Forbes’ emphasis on financial ratings helps consumers make informed decisions and choose insurers that are both affordable and financially sound.

Digital Experience and Mobile Apps

In today’s digital age, a seamless and user-friendly online experience is paramount for auto insurance customers. Forbes recognizes this and considers the digital experience offered by insurance companies as a significant factor in its rankings. This encompasses the ease of navigation, accessibility, and functionality of their websites and mobile applications. A positive digital experience translates to greater customer satisfaction and efficiency in managing insurance needs.Forbes evaluates how well insurance companies leverage technology to provide convenient and efficient services to their customers.

This evaluation extends to the accessibility of information, the availability of online tools, and the overall design and functionality of their digital platforms. The accessibility of these digital platforms for users with disabilities is also considered.

User-Friendliness of Websites and Mobile Apps

Forbes analyzes the intuitiveness and ease of use of insurance companies’ websites and mobile apps. A well-designed platform allows users to quickly find the information they need, such as policy details, coverage options, and claims information. Cluttered interfaces and complicated navigation can lead to frustration and a negative user experience.The assessment includes factors such as:

- Intuitive Navigation: Can users easily find what they are looking for without getting lost in a maze of menus?

- Clear Information Architecture: Is information organized logically and presented in a clear and concise manner?

- Mobile Responsiveness: Does the website or app function seamlessly across different devices (desktops, tablets, smartphones)?

- Visual Design: Is the design aesthetically pleasing and easy on the eyes, avoiding overwhelming amounts of text or distracting graphics?

A positive user experience encourages customers to engage with the insurance company’s digital platforms and efficiently manage their policies.

Features Contributing to a Positive Digital Experience

Forbes identifies specific features that significantly contribute to a positive digital experience. These features empower customers to manage their insurance needs efficiently and conveniently.These key features include:

- Online Claims Filing: The ability to initiate and track claims online simplifies the claims process and reduces paperwork.

- Policy Management: Customers should be able to easily view, update, and manage their policy details online, including coverage limits, deductibles, and payment information.

- Digital ID Cards: Access to digital insurance cards through the mobile app provides convenient proof of insurance.

- Payment Options: A variety of online payment options, including credit cards, debit cards, and electronic fund transfers, provide flexibility and convenience.

- Customer Support: Access to online chat, email support, and FAQs provides quick and easy assistance with questions or concerns.

- Quote Generation: The ability to obtain instant quotes online allows prospective customers to quickly compare rates and coverage options.

- Document Upload: The capability to securely upload documents related to claims or policy changes streamlines communication with the insurance company.

These features enhance customer satisfaction and contribute to a more efficient and transparent insurance experience.

Impact of Digital Accessibility on Forbes’ Rankings

Forbes considers digital accessibility as a crucial aspect of the overall digital experience. Websites and mobile apps should be accessible to individuals with disabilities, ensuring that everyone can access and utilize the services offered. This includes adherence to accessibility standards such as the Web Content Accessibility Guidelines (WCAG).Digital accessibility considerations include:

- Screen Reader Compatibility: Ensuring that the website and app are compatible with screen readers used by visually impaired individuals.

- Keyboard Navigation: Allowing users to navigate the website and app using only a keyboard, without requiring a mouse.

- Alternative Text for Images: Providing descriptive alternative text for images, allowing screen readers to convey the image’s content to visually impaired users.

- Sufficient Color Contrast: Ensuring sufficient color contrast between text and background colors to improve readability for individuals with visual impairments.

- Clear and Simple Language: Using clear and simple language to make the content accessible to individuals with cognitive disabilities.

Insurance companies that prioritize digital accessibility demonstrate a commitment to inclusivity and are favorably viewed by Forbes. Companies failing to meet accessibility standards may receive lower ratings.

Regional Availability and Forbes’ Recommendations

Forbes’ auto insurance reviews strive to provide comprehensive guidance to consumers nationwide. A crucial aspect of this guidance involves acknowledging the significant impact of regional factors on insurance availability and pricing. These factors can include state-specific regulations, population density, local accident rates, and even the prevalence of certain types of vehicles. Therefore, Forbes attempts to account for these variations when evaluating and recommending insurance providers.Forbes understands that auto insurance isn’t a one-size-fits-all product.

The optimal insurance company for a driver in rural Montana may differ significantly from the best choice for someone living in congested Los Angeles. Consequently, their evaluations consider how well insurance companies adapt to the specific needs and circumstances of drivers in different regions.

Forbes’ Approach to Regional Insurance Variations

Forbes’ approach to regional variations in insurance availability and pricing is multifaceted. They analyze data from various sources, including rate comparison websites, consumer surveys, and direct quotes from insurance companies, to understand how premiums differ across states and even within different areas of the same state. This data-driven approach helps them identify companies that offer competitive rates and tailored coverage options in specific regions.Furthermore, Forbes also considers the regulatory landscape in each state.

Insurance regulations vary significantly from state to state, and Forbes’ reviews take into account how well insurance companies comply with these regulations and protect the interests of their policyholders. This includes factors such as minimum coverage requirements, no-fault insurance laws, and the availability of specific types of coverage, such as uninsured/underinsured motorist protection.

National vs. Regional Insurers in Forbes’ Recommendations

Forbes’ recommendations do not exclusively favor either national or regional insurance companies. Instead, they prioritize identifying insurers that offer the best value and service in specific regions. While national insurers often have the advantage of brand recognition and widespread availability, regional insurers can sometimes provide more personalized service and competitive rates due to their local expertise and lower overhead costs.Ultimately, Forbes’ recommendations are based on a combination of factors, including price, coverage options, customer service, financial strength, and digital experience.

The relative importance of these factors may vary depending on the individual needs and preferences of the driver, as well as the specific characteristics of the region in which they live. For instance, in areas prone to natural disasters, coverage options related to flood or earthquake damage might weigh more heavily in the evaluation.

Examples of Regional Insurers with Positive Mentions

Several regional insurers have received positive mentions from Forbes for their strong performance in specific areas. These companies often excel in customer satisfaction, claims handling, or pricing within their respective regions.Here are some examples of regional insurers that have garnered attention:

- Erie Insurance: Erie Insurance is frequently praised for its excellent customer service and competitive rates in the Mid-Atlantic and Midwestern states. They consistently rank high in customer satisfaction surveys and are known for their responsive claims handling.

- Auto-Owners Insurance: Auto-Owners Insurance is another regional insurer that has received positive recognition for its strong financial strength and commitment to customer service, particularly in the Southeast and Midwest. They often work through independent agents, which can provide a more personalized experience.

- NJM Insurance Group: Primarily serving New Jersey and Pennsylvania, NJM Insurance Group is often lauded for its competitive pricing and focus on safety. They have a strong reputation for providing affordable coverage to drivers in these densely populated states.

These examples demonstrate that regional insurers can be strong contenders for auto insurance coverage, especially for drivers who value personalized service and competitive rates within their local area. Forbes’ reviews help consumers identify these regional players and assess their suitability based on their individual needs and circumstances.

Discounts and Savings Opportunities

Forbes emphasizes that finding the best auto insurance involves not only comparing coverage and customer service but also actively seeking discounts and savings opportunities. Understanding and leveraging available discounts can significantly lower your premium, making insurance more affordable without sacrificing essential protection. Forbes highlights various discounts offered by different insurers, encouraging consumers to explore all possible avenues for savings.Forbes presents information about potential savings opportunities by providing clear explanations of common discounts and illustrating how these discounts can translate into tangible cost reductions.

The platform often includes examples of how specific demographics or driving habits can qualify individuals for lower rates. This transparency helps consumers understand which discounts they are most likely to be eligible for and how to proactively pursue them.

Common Auto Insurance Discounts Highlighted by Forbes

Forbes typically lists several common auto insurance discounts that consumers should be aware of when shopping for coverage. These discounts reflect factors that statistically reduce the risk of accidents or claims, and insurers offer them as incentives for responsible behavior and policy management.

- Safe Driver Discount: This discount is offered to drivers with a clean driving record, meaning no accidents or traffic violations for a specified period, usually three to five years. For example, a driver with five years of accident-free driving might qualify for a discount of 10-20% on their premium.

- Multi-Policy Discount: Insurers often provide discounts to customers who bundle multiple insurance policies, such as auto and home insurance. This can result in significant savings; bundling policies could save you anywhere from 5% to 15% on each policy.

- Multi-Car Discount: If you insure multiple vehicles under the same policy, you may be eligible for a multi-car discount. This discount acknowledges the reduced administrative costs for the insurer and the increased loyalty of the customer. The savings can range from 10% to 25% depending on the insurer and the number of vehicles insured.

- Good Student Discount: Many insurers offer discounts to students who maintain a B average or higher. This discount recognizes that students who are responsible in their studies are often more responsible drivers. Students may need to provide proof of their academic standing to qualify.

- Low Mileage Discount: If you drive fewer miles than average each year, you might qualify for a low mileage discount. Insurers see low mileage as an indicator of lower risk of accidents. Some insurers use telematics devices to track mileage accurately.

- Vehicle Safety Features Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and anti-theft devices, may qualify for discounts. These features reduce the likelihood of accidents and theft, leading to lower insurance costs.

- Affiliation Discounts: Some insurers offer discounts to members of certain organizations, such as alumni associations, professional groups, or employer groups. These affiliations often come with pre-negotiated discounts for members.

- Payment Method Discounts: Insurers sometimes offer discounts for choosing certain payment methods, such as paying the entire premium upfront or enrolling in automatic payments. These methods reduce administrative costs and ensure timely payments.

Forbes’ Presentation of Potential Savings Opportunities

Forbes typically presents potential savings opportunities by providing specific examples and highlighting the percentage or dollar amount that consumers could save by taking advantage of various discounts. The platform also emphasizes the importance of comparing quotes from multiple insurers to identify the best combination of coverage and discounts. Forbes might include articles or tools that allow users to estimate their potential savings based on their individual circumstances.

For instance, Forbes could showcase a scenario where a family bundling their auto and home insurance saves $500 annually, illustrating the tangible benefits of such discounts.

Ways Consumers Can Save Money on Auto Insurance

Consumers have several strategies they can employ to save money on auto insurance, beyond just the standard discounts. These approaches involve proactive steps and informed decision-making to optimize coverage and minimize premiums.

- Increase Your Deductible: Choosing a higher deductible can significantly lower your premium. However, it’s essential to ensure you can comfortably afford the deductible in case of an accident. For example, increasing your deductible from $500 to $1000 could reduce your premium by 10-20%.

- Compare Quotes Regularly: Auto insurance rates can change frequently, so it’s wise to compare quotes from multiple insurers at least once a year. This ensures you’re always getting the best possible rate for your coverage needs.

- Improve Your Credit Score: In many states, insurers use credit scores to assess risk. Improving your credit score can lead to lower insurance premiums. Paying bills on time and reducing debt are effective ways to improve your creditworthiness.

- Drive Safely: Maintaining a clean driving record is crucial for keeping insurance rates low. Avoid accidents and traffic violations, as these can significantly increase your premium. Consider taking a defensive driving course, which may qualify you for a discount.

- Review Your Coverage Needs: Periodically review your coverage needs to ensure you’re not paying for coverage you don’t need. For example, if your car is older, you might consider dropping collision or comprehensive coverage if the value of the car is less than the deductible.

- Pay in Full: Paying your insurance premium in full upfront can sometimes result in a discount compared to paying in monthly installments. This reduces the insurer’s administrative costs and ensures timely payment.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits using telematics devices or mobile apps. If you’re a safe driver, you could qualify for significant discounts based on your actual driving behavior.

- Shop Around for the Best Rates for Specific Coverage: Not all insurers offer the best rates for every type of coverage. One insurer might be competitive on liability coverage, while another excels in comprehensive coverage. By understanding your specific needs and shopping around accordingly, you can optimize your savings.

Illustrative Examples of Highly Ranked Insurers

Choosing the right auto insurance can feel overwhelming, with numerous companies offering a variety of coverage options. To simplify the process, examining the profiles of highly-ranked insurers can provide valuable insights into what makes a top-tier provider. This section will detail three such insurers, highlighting their services, customer support, financial strength, and other vital statistics. By understanding the strengths of these leading companies, consumers can better evaluate their own needs and make informed decisions.The following sections will profile three prominent auto insurance companies, each consistently recognized for its excellence in various aspects of the insurance industry.

These profiles will offer a detailed look at their core offerings, customer service approach, financial stability, and digital capabilities.

State Farm Insurer Profile

State Farm is a widely recognized and highly rated auto insurance provider, known for its extensive network of agents and comprehensive coverage options. Their commitment to customer service and financial stability makes them a popular choice for drivers across the United States.State Farm’s key features include:

- Extensive Agent Network: State Farm operates with a large network of local agents, providing personalized service and readily available support for policyholders. This contrasts with some direct insurers that primarily offer online or phone-based interactions.

- Comprehensive Coverage Options: Beyond standard liability, collision, and comprehensive coverage, State Farm offers options like uninsured/underinsured motorist coverage, medical payments coverage, and rental car reimbursement. They also provide rideshare insurance in many states.

- Strong Financial Stability: State Farm consistently receives high ratings from independent rating agencies like A.M. Best, indicating its financial strength and ability to pay out claims. This provides policyholders with peace of mind knowing their insurer is stable and reliable.

- Customer Service Focus: State Farm is often praised for its customer service, with many agents building long-term relationships with their clients. They offer 24/7 claims reporting and strive to resolve issues quickly and efficiently.

An example of State Farm’s customer service focus is their “Drive Safe & Save” program, which uses telematics to monitor driving habits and offer discounts to safe drivers. This proactive approach to risk management and customer engagement demonstrates their commitment to both safety and customer satisfaction.

GEICO Insurer Profile

GEICO is another leading auto insurance provider, known for its competitive rates, user-friendly online platform, and strong financial standing. GEICO focuses on providing affordable insurance options while maintaining a high level of customer satisfaction.GEICO’s key features include:

- Competitive Pricing: GEICO is renowned for its competitive rates, often attracting customers seeking the lowest possible premiums. They achieve this through efficient operations and a direct-to-consumer business model.

- User-Friendly Digital Experience: GEICO offers a seamless online experience, allowing customers to easily obtain quotes, manage their policies, and file claims through their website and mobile app.

- Strong Financial Strength: Similar to State Farm, GEICO boasts high financial strength ratings, assuring policyholders of its ability to meet its financial obligations.

- Wide Range of Discounts: GEICO provides a variety of discounts, including discounts for safe drivers, students, military personnel, and those who bundle their auto insurance with other policies.

GEICO’s commitment to digital innovation is exemplified by their mobile app, which allows customers to submit accident photos, track claims progress, and access roadside assistance with ease. This emphasis on convenience and accessibility appeals to tech-savvy consumers.

Progressive Insurer Profile

Progressive is a well-known auto insurance company that stands out for its innovative approach to pricing and its “Name Your Price” tool. They are also recognized for their Snapshot program, which uses telematics to offer personalized rates based on driving behavior.Progressive’s key features include:

- “Name Your Price” Tool: Progressive’s “Name Your Price” tool allows customers to specify the amount they’re willing to pay for auto insurance, and Progressive will then show coverage options that fit their budget.

- Snapshot Program: Progressive’s Snapshot program monitors driving habits and offers discounts to safe drivers. This program encourages safe driving and rewards responsible policyholders.

- Variety of Coverage Options: Progressive offers a range of coverage options, including standard liability, collision, and comprehensive coverage, as well as options like gap insurance and roadside assistance.

- Online and Mobile Accessibility: Progressive provides a user-friendly online platform and mobile app, allowing customers to manage their policies, file claims, and access customer support.

An example of Progressive’s innovation is their Accident Forgiveness program, which prevents rates from increasing after the first at-fault accident for customers who meet certain eligibility requirements. This provides added security and peace of mind for drivers.

Illustrative Scenarios for Auto Insurance Claims

Navigating the auto insurance claims process can be daunting, especially after an accident. Understanding how different types of incidents are handled and the steps involved can significantly ease the process and ensure you receive the appropriate coverage. The following scenarios illustrate common situations and how a driver should utilize their insurance policy.Knowing the proper procedures for filing a claim and understanding the coverage options available can protect you financially and legally after an accident.

These scenarios highlight the importance of having adequate insurance and knowing how to use it effectively.

Rear-End Collision and Insurance Claim Process

Imagine you are stopped at a red light when another vehicle fails to stop and rear-ends your car. This is a common accident scenario, and understanding how to proceed with an insurance claim is crucial.Here’s how the claim process typically unfolds:

- Assess the Situation and Ensure Safety: First and foremost, check yourself and any passengers for injuries. If anyone is hurt, call for medical assistance immediately. Move the vehicles to a safe location, if possible, to avoid further accidents.

- Document the Scene: Take photos of the damage to both vehicles, the accident scene, and any visible injuries. Exchange information with the other driver, including their name, address, phone number, insurance company, and policy number. Obtain contact information from any witnesses.

- Notify the Police: Depending on the severity of the accident and local regulations, you may need to notify the police. A police report can be valuable documentation for your insurance claim.

- Contact Your Insurance Company: Report the accident to your insurance company as soon as possible. Provide them with all the information you have gathered, including photos, the police report (if applicable), and the other driver’s information.

- File a Claim: Your insurance company will guide you through the claim filing process. They may ask you to complete a claim form and provide additional documentation.

- Vehicle Inspection and Damage Assessment: Your insurance company will likely arrange for an inspection of your vehicle to assess the damage. They may have preferred repair shops, or you can choose your own. Obtain an estimate for the repairs.

- Claim Settlement: Once the damage assessment is complete, your insurance company will determine the amount they will pay for the repairs. If you agree with the settlement, they will issue a payment to you or directly to the repair shop. If the other driver is at fault, your insurance company may subrogate (seek reimbursement) from their insurance company.

In this scenario, if the other driver is at fault, their liability insurance should cover the damages to your vehicle and any injuries you sustained. However, if the other driver is uninsured or underinsured, your uninsured/underinsured motorist coverage would come into play.

Hit-and-Run Incident and Insurance Claim Process

Consider a situation where you return to your parked car and discover it has been damaged, with no note or information left by the responsible party. This is a hit-and-run incident, and your insurance coverage can help.Here’s how to handle the insurance claim:

- Report the Incident to the Police: The first step is to report the incident to the police. Obtain a police report, as this will be required by your insurance company.

- Document the Damage: Take photos of the damage to your vehicle. Note any details that might help identify the responsible party, such as paint transfer or debris left at the scene.

- Contact Your Insurance Company: Report the incident to your insurance company and provide them with the police report and photos of the damage.

- File a Claim: File a claim under your collision coverage. In some cases, if the other driver is identified, your insurance company may pursue them for reimbursement.

- Vehicle Inspection and Damage Assessment: Your insurance company will arrange for an inspection of your vehicle to assess the damage. Obtain an estimate for the repairs.

- Claim Settlement: Your insurance company will determine the amount they will pay for the repairs, minus your deductible. They will issue a payment to you or directly to the repair shop.

In a hit-and-run scenario, your collision coverage will typically cover the damages to your vehicle, subject to your deductible. Uninsured motorist property damage coverage may also apply in some states.

Multi-Vehicle Pile-Up and Insurance Claim Process

Imagine you are involved in a multi-vehicle pile-up on a highway due to inclement weather. Determining fault and navigating the insurance claims process can be complex.Here’s how to proceed:

- Ensure Safety and Seek Medical Attention: As with any accident, prioritize safety. Check for injuries and call for medical assistance if needed. Move vehicles to a safe location, if possible.

- Document the Scene: Take photos of the accident scene, including the positions of the vehicles, the damage to each vehicle, and any relevant environmental factors (e.g., weather conditions). Exchange information with all other drivers involved, including their insurance information.

- Notify the Police: Given the complexity of a multi-vehicle accident, it is essential to notify the police. A police report will be crucial for determining fault and navigating the insurance claims process.

- Contact Your Insurance Company: Report the accident to your insurance company as soon as possible. Provide them with all the information you have gathered, including photos, the police report, and the other drivers’ information.

- File a Claim: Your insurance company will guide you through the claim filing process. They may conduct an investigation to determine fault.

- Determine Fault and Liability: In a multi-vehicle pile-up, determining fault can be complex and may involve multiple parties. Insurance companies will investigate the accident and assign fault based on factors such as following distance, speed, and road conditions.

- Claim Settlement: Depending on who is determined to be at fault, your insurance company will either pay for the damages to your vehicle or pursue claims against other drivers’ insurance companies. If you are found to be partially at fault, your liability coverage may be used to cover damages to other vehicles.

In a multi-vehicle pile-up, the process of determining fault and settling claims can be lengthy and complex. It is essential to cooperate with your insurance company and provide them with all the information they need to investigate the accident thoroughly.

Outcome Summary

Ultimately, Forbes Best Auto Insurance list serves as a crucial guide for consumers seeking reliable and affordable auto insurance. By considering factors beyond just price, Forbes helps individuals make informed decisions, ensuring they choose an insurer that meets their specific needs and provides peace of mind on the road. Careful consideration of Forbes’ recommendations, combined with personal research, can lead to a better and more secure insurance experience.